Online gambling transactions are subject to a complicated regulatory framework that differs greatly across jurisdictions. Federal, state, municipal, and, where relevant, international rules all have an impact on it. Important features of this terrain consist of:

License Requirements:

In order for gaming operators to lawfully engage in online gaming operations, several countries need them to get a special license. This may include applying for licenses from gaming commissions or other regulatory agencies, which often have strict guidelines.

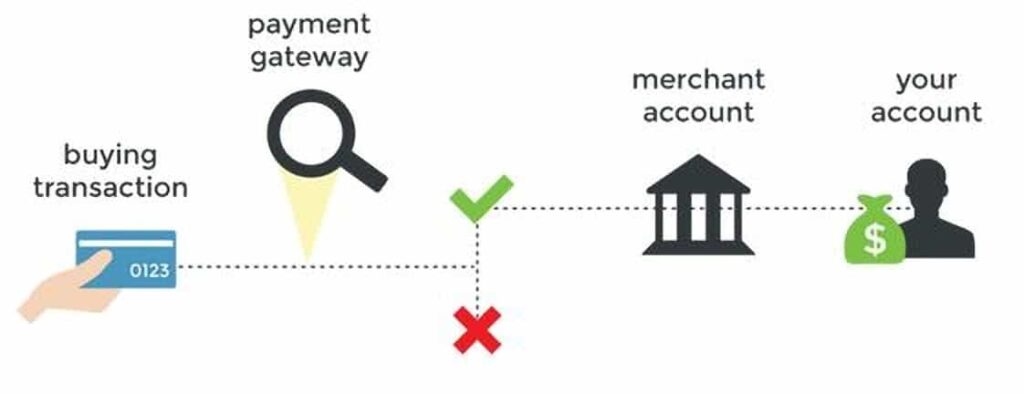

Regulations for Payment Processing:

Payment handling for online gambling transactions is often under investigation. In the United States, laws like the Unlawful Internet Gambling Enforcement Act (UIGEA) prohibit banks and payment processors from handling transactions pertaining to illegal online gambling. Operators must so make sure that their payment options abide by these rules.

Rules Regarding Know Your Customer (KYC):

KYC requirements mandate that gambling operators authenticate their customers before granting them access to gamble, with the aim of thwarting fraud and money laundering. This entails gathering personal data and verifying the accuracy of the information submitted.

Anti-Money Laundering (AML) Compliance:

Companies that provide online gambling must have policies in place to identify and report any suspicious activity that may be related to money laundering. Depending on the jurisdiction, AML requirements may require operators to keep thorough records of all transactions and contacts with customers.

Laws Protecting Consumers:

These regulations are intended to protect participants from deception and guarantee fair play. Adherence to legislation concerning data security, arbitration procedures, and responsible gaming methodologies is crucial.

Global Standards:

Online gambling operators must be aware of the legislation of the markets they service and maintain compliance with both home and host country laws. Since many online gaming operators participate in cross-border transactions, they are subject to international regulations such as those issued by the Financial Action Task Force (FATF).

Compliance Is Crucial for Merchant Account Setup Risk Mitigation:

Following the law lowers the possibility of facing fines, penalties, or even criminal prosecution. Licenses may be revoked for breaking the rules, which might completely ruin an online gaming company.

Establishing Credibility and Trust:

Customers and payment processors will respect a gaming company that places a high priority on compliance. Building a reputation for moral behavior may benefit financial institutions and customers alike by increasing loyalty.

Obtaining Payment Solutions:

Because there are inherent dangers associated with partnering with firms in the online gambling market, many payment processors have strict policies concerning it. Encouraging partnerships with payment processing partners and streamlining the online gaming merchant account acquisition process are two benefits of compliance.

Conclusion

Businesses hoping to operate lawfully must comprehend and navigate the regulatory environment as online gambling continues to develop. Maintaining compliance while opening a merchant account is crucial for creating a reliable and long-lasting gaming business, not merely to avoid fines. Online gaming companies may build their reputation, streamline operations, and satisfy customers by putting regulatory compliance first. This can eventually lead to long-term success in a very competitive sector.